Turkish Citizenship by Investment

Overview: The Turkish Citizenship by Investment Program

Turkish Citizenship by Investment represents a sophisticated legal pathway for international investors seeking to secure a Turkish passport by investment through tangible economic contributions. Often compared to global Turkey Golden Visa residency schemes, this program is distinct in offering full naturalization rights rather than temporary status. For foreign nationals, acquiring a Turkey second passport facilitates not only unrestricted access to the domestic market but also enhanced global mobility.

Grounded in Turkish citizenship law (Law No. 5901), this expedited naturalization procedure allows eligible applicants to bypass standard residency duration requirements. The Turkey investment citizenship program is structured to grant citizenship to those who fulfill specific capital thresholds—ranging from real estate to financial instruments. A key advantage is the program's inclusivity; the main investor’s spouse and children under 18 can also obtain the benefits of Turkish citizenship, including access to the national healthcare system and educational institutions.

However, transitioning from an investor to a citizen requires rigorous administrative compliance and verification. For applicants managing portfolios from key economic centers like Izmir, professional legal oversight is indispensable. At KL Legal Consultancy, we ensure that every stage of the application is structured with precision, enabling clients to navigate the citizenship by investment in Turkey process efficiently while mitigating bureaucratic risks.

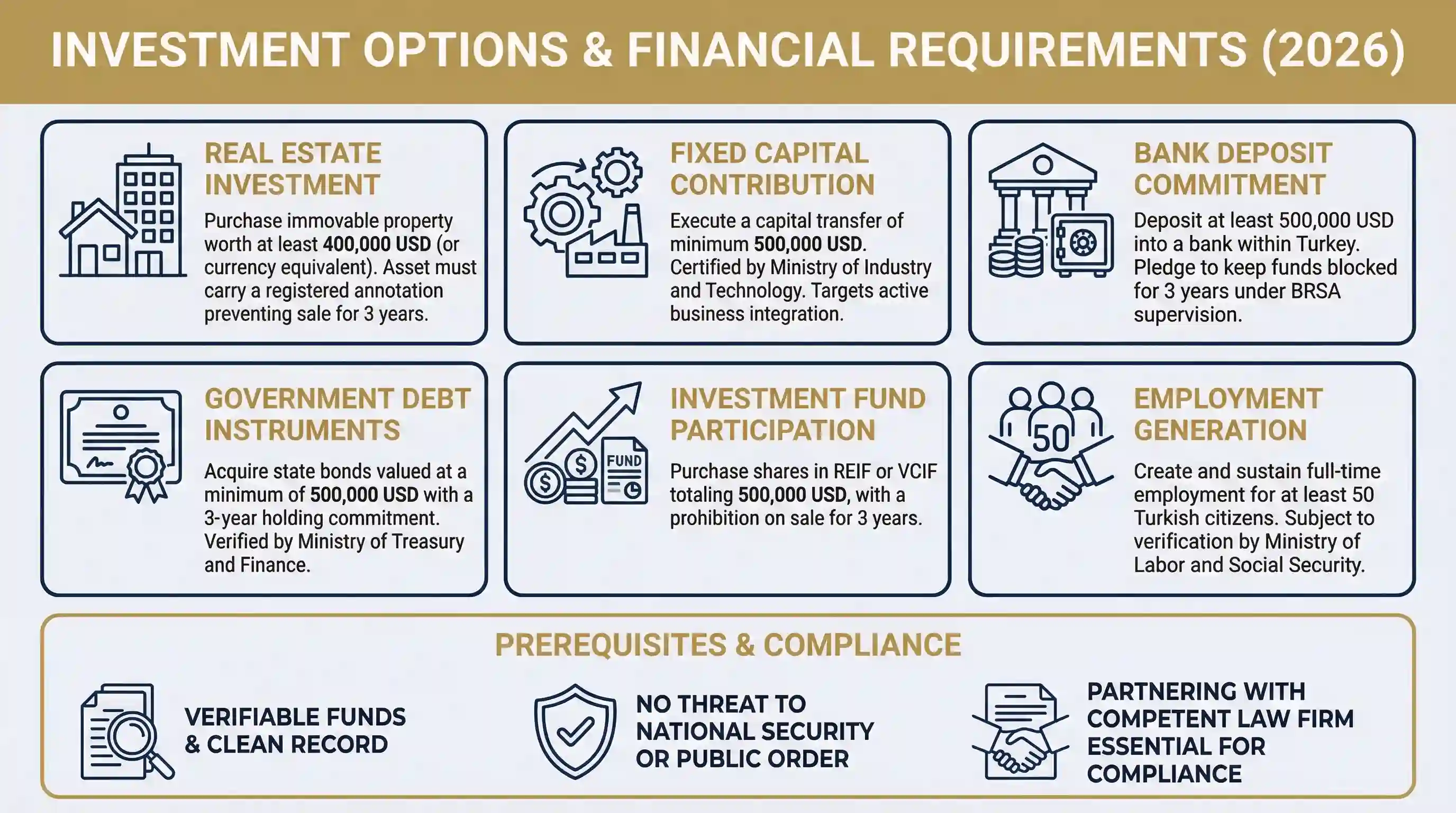

Investment Options & Financial Requirements (2026)

The regulatory framework for naturalization is strictly defined by Presidential Decree, requiring applicants to meet specific financial thresholds while proving that all funds originate from verifiable sources. To satisfy the updated Turkish citizenship requirements, foreign investors must fulfill one of the designated economic contribution conditions. These routes are designed not only to attract capital but to foster long-term economic engagement.

The primary methods for meeting the Turkey citizenship minimum investment amount include:

- Real Estate Investment: Purchasing immovable property (housing, land, or commercial) worth at least 400,000 USD (or currency equivalent). This asset must carry a registered annotation preventing its sale for three years, making it the most common method for buying property in Turkey for citizenship.

- Fixed Capital Contribution: Executing a capital transfer of minimum 500,000 USD, certified by the Ministry of Industry and Technology. This route is legally categorized as Turkey citizenship by capital investment and targets active business integration.

- Bank Deposit Commitment: Depositing at least 500,000 USD into a bank operating within Turkey. Often researched as Turkish citizenship bank deposit, this option requires a pledge to keep the funds blocked for three years under the supervision of the Banking Regulation and Supervision Agency (BRSA).

- Government Debt Instruments: Acquiring state bonds valued at a minimum of 500,000 USD with a three-year holding commitment, verified by the Ministry of Treasury and Finance.

- Investment Fund Participation: Purchasing shares in Real Estate Investment Funds (REIF) or Venture Capital Investment Funds (VCIF) totaling 500,000 USD, with a prohibition on sale for three years.

- Employment Generation: Creating and sustaining full-time employment for at least 50 Turkish citizens, subject to verification by the Ministry of Labor and Social Security.

Fulfilling the minimum investment in Turkey for citizenship is merely the financial prerequisite. Applicants must also demonstrate a clean criminal record and pose no threat to national security or public order. Given the depth of scrutiny applied to capital movements and personal background checks, partnering with a competent Turkey citizenship law firm is essential. For investors operating out of Izmir and surrounding regions, ensuring that investment files are legally compliant prevents delays during the official review process.

Option 1: Real Estate Investment ($400,000)

The property market offers a dynamic route for naturalization, making the real estate Turkey for foreigners sector a primary focal point for global investors. Regulated under the scope of exceptional citizenship, this pathway allows foreign nationals to acquire full status by purchasing immovable property, provided it meets rigorous valuation and regulatory standards. It transforms a conventional real estate transaction into a distinct legal procedure requiring seamless coordination between the Land Registry and the Ministry of Environment, Urbanization and Climate Change.

To satisfy the criteria, the investor must acquire property with a minimum value of 400,000 USD (a threshold widely recognized as Turkish citizenship investment 400k). The critical legal condition is the registration of a restrictive annotation on the title deed, pledging that the asset will not be sold for at least three years. Once the acquisition is finalized, obtaining a Certificate of Conformity is the mandatory next step to validate the investment for immigration purposes.

Key Rules for Property Eligibility

Successfully buying property in Turkey for citizenship involves strictly adhering to technical rules that go beyond standard purchasing procedures:

- Valuation Consistency: An official valuation report is required. The value declared in the title deed must match or exceed both the valuation report figure and the minimum investment in Turkey for citizenship threshold.

- Foreign Exchange Purchase Certificate (DAB): The buyer is legally required to convert foreign currency into Turkish Lira through a bank, which then sells it to the Central Bank prior to the title transfer. The DAB document is the official proof of this transaction.

- Ownership & Seller Restrictions: Properties located in military security zones or in districts exceeding the 10% foreign ownership quota are ineligible. Additionally, the seller must be a Turkish citizen or a Turkish-owned company; buying from another foreigner disqualifies the investment.

- Land Development Obligations: If the investment is made in land (zoned or unzoned) rather than a completed building, the investor is generally required to submit a construction project to the relevant ministry within two years to maintain eligibility.

For investors targeting competitive markets like Izmir, distinguishing between a purely commercial asset and a "citizenship-eligible" property is vital. Assets with undisclosed legal disputes or encumbrances can indefinitely stall the naturalization process. Therefore, engaging a specialized Turkey citizenship lawyer or an Izmir citizenship application lawyer is critical to conduct deep due diligence, ensuring the investment property Turkey citizenship dossier is legally sound and risk-free.

Option 2: Fixed Capital Investment ($500,000)

The Turkey citizenship by capital investment route is tailored for foreign nationals seeking to integrate their immigration status with active commercial engagement. Unlike passive asset holding, this pathway demonstrates a direct contribution to the nation's industrial or commercial infrastructure.

Under the prevailing Turkish citizenship investment law, eligibility is granted to investors who make a fixed capital investment of at least 500,000 USD (or equivalent). The defining characteristic of this method is the requirement for validation by the Ministry of Industry and Technology. To finalize the application, the investor must secure an "Investment Eligibility Certificate," confirming that the capital has been deployed effectively within the economy.

Approved Investment Structures:

- New Entity Formation: Establishing a wholly foreign-owned company or joint venture in Turkey, backed by fixed asset purchases meeting the threshold.

- Capital Increase: Injecting funds to raise the capital of an existing Turkish company by the minimum Turkish citizenship investment 500k amount.

- Industrial Expenditures: Direct investment in production facilities, machinery, or infrastructure projects.

It is critical to note that a simple wire transfer to a company account does not suffice; the investment must be substantiated through documented fixed assets and operational activity. Since this pathway operates at the intersection of corporate governance and immigration policy, precise legal structuring is non-negotiable. For investors launching commercial ventures in industrial hubs like Izmir, seeking professional legal assistance for Turkish citizenship is strongly advised to ensure the corporate setup aligns perfectly with naturalization criteria.

Option 3: Bank Deposit Citizenship ($500,000)

For investors prioritizing asset liquidity and operational simplicity, the Turkish citizenship by bank deposit option offers a streamlined alternative to property management. This pathway is particularly attractive for those seeking to secure naturalization without the ongoing maintenance responsibilities associated with real estate, while maintaining capital preservation in a regulated financial environment.

To qualify, an applicant is required to deposit a minimum of 500,000 USD (or its equivalent in other eligible currencies) into a bank operating within Turkey. The fundamental legal condition is the execution of a formal commitment that these funds will remain in the account for three years. This process is rigorously monitored by the Banking Regulation and Supervision Agency (BRSA) to ensure strict adherence to how to get Turkish citizenship regulations.

How to Secure the 3-Year Blocked Account

While the concept of a deposit is straightforward, executing the transaction for citizenship purposes involves specific compliance protocols:

- Minimum Threshold: The deposited amount must satisfy the Turkish citizenship investment 500k requirement at the exact time of the transaction, regardless of future currency fluctuations.

- Account Ownership: The account must be opened solely in the name of the main applicant; joint accounts or company accounts generally do not qualify.

- Blocking Instruction: The investor must sign a specific pledge instructing the bank that the principal amount is blocked from withdrawal. However, any accrued interest or dividends generated during the holding period typically remain freely accessible to the investor.

- Source of Funds (KYC): Turkish banks enforce strict "Know Your Customer" protocols. Investors must be prepared to provide transparent documentation regarding the legitimate origin of the funds before the transfer is accepted.

Navigating these banking procedures requires precise coordination between the investor, the bank, and the regulatory body. For investors managing financial transfers through institutions in Izmir, engaging a Turkish citizenship by investment lawyer is indispensable. Legal professionals ensure that the "blocking" status is correctly annotated in the system and that the BRSA approval is secured without administrative delays.

Option 4 & 5: Government Bonds and Investment Funds

For investors seeking financial assets backed by public guarantees or professional portfolio management, the Turkey investment citizenship program offers two sophisticated capital market pathways: State Debt Instruments and Investment Funds. These options are often preferred by those looking to diversify their portfolio while securing naturalization status.

Government Bonds ($500,000)

Foreign nationals have the option to purchase Turkish citizenship government bonds valued at a minimum of 500,000 USD. The primary legal obligation for this route is the commitment to hold these instruments for at least three years without sale or early redemption.

- Regulatory Oversight: The entire transaction is monitored and verified by the Ministry of Treasury and Finance.

- Mechanism: Once the debt instruments are purchased, a "blocking instruction" is placed on the account to prevent early liquidation. This is generally considered a conservative, low-risk option for investors aiming to meet the Turkish citizenship investment 500k threshold with state-backed security.

REIFs and VCIFs Investment ($500,000)

A widely preferred alternative to direct investment property Turkey citizenship—which involves property maintenance and tax management—is the purchase of participation shares in Real Estate Investment Funds (REIFs) or Venture Capital Investment Funds (VCIFs).

- Investment Requirement: A minimum capital allocation of 500,000 USD must be made into eligible fund shares.

- Holding Period: Similar to other routes, these shares must be held for three years under a strict non-sale commitment.

- Audit Authority: The Capital Markets Board (CMB/SPK) conducts the compliance audit to ensure the fund qualifies for citizenship purposes.

Selecting the correct fund is critical; investing in a non-accredited fund can invalidate the entire application. Therefore, investors managing portfolios from financial hubs like Izmir are advised to work closely with a Turkish citizenship lawyer to verify that the chosen instruments fully comply with the latest Capital Markets Board regulations.

Option 6: Employment Creation (50 Jobs)

Acquiring Turkish citizenship by investment through employment creation is a pathway designed for active foreign entrepreneurs committed to strengthening the local labor market. Unlike passive capital transfers, this route requires the applicant to generate and sustain full-time employment for at least 50 Turkish citizens. This economic contribution is subject to strict verification and approval by the Ministry of Labor and Social Security.

Requirements for Business Continuity

To meet the eligibility standards, the employment provided must be genuine, legally registered, and financially sustainable:

- Social Security Registration: All 50 employees must be officially registered with the Social Security Institution (SGK), with premiums fully paid.

- Business Continuity: The enterprise must demonstrate financial stability through official tax records and balance sheets, proving it can sustain the workforce for the foreseeable future under Turkish citizenship investment law.

- Regulatory Adherence: The employment must adhere to all aspects of Turkish Labor Law, preventing any compliance gaps that could jeopardize the citizenship application.

Given the operational complexity of managing a workforce of this magnitude, this route demands continuous legal oversight. Business owners operating in major commercial centers, such as those in Izmir, are advised to collaborate with an experienced Turkey work permit lawyer or a corporate immigration specialist. Professional legal guidance ensures that employment figures and workplace standards remain fully compliant with both labor regulations and naturalization requirements.

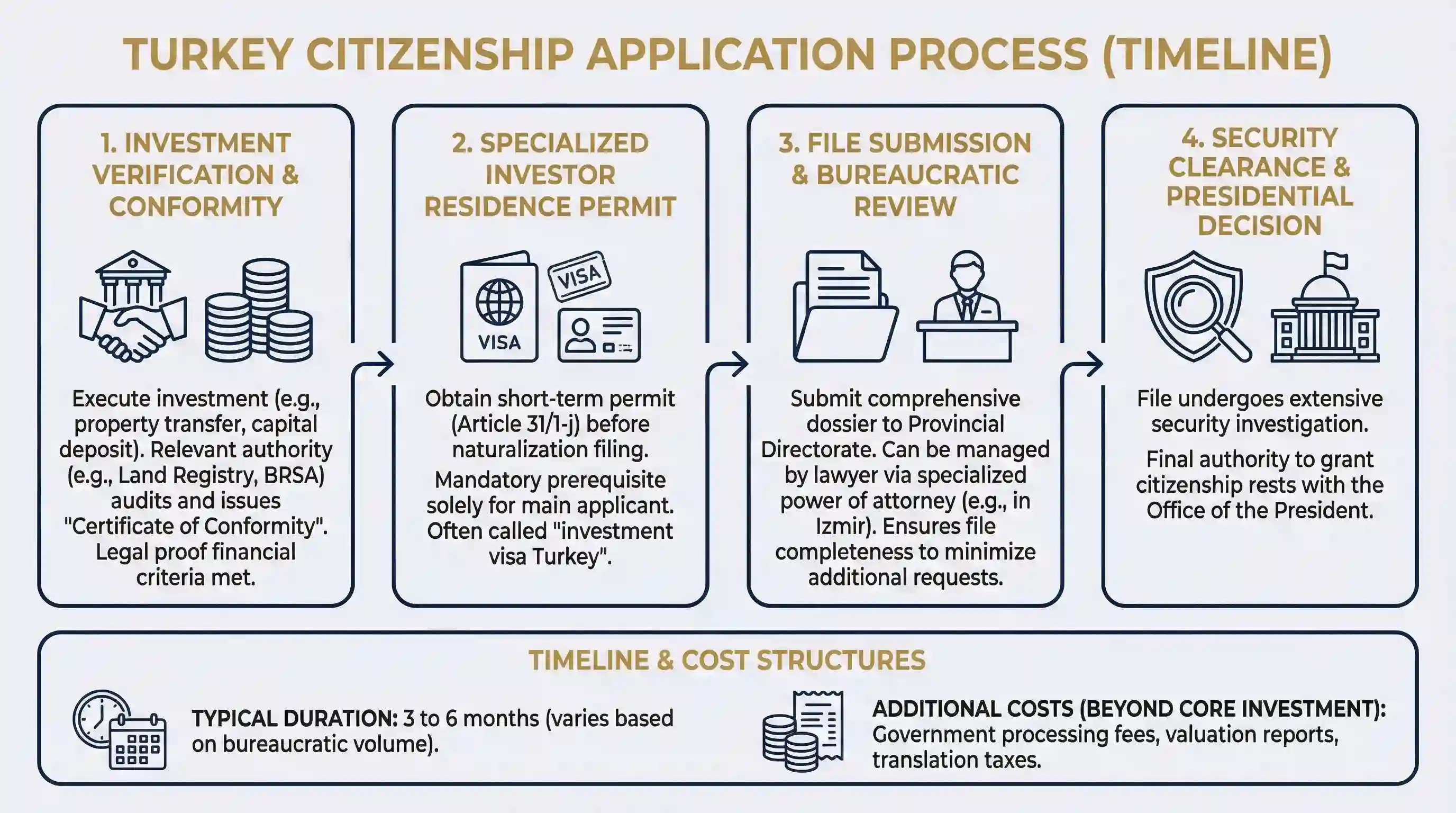

Step-by-Step Application Process (Timeline)

Foreign nationals aiming to successfully complete the Turkey citizenship application process must navigate a multi-stage legal workflow that extends significantly beyond the initial capital transfer. This procedure is legally sequential; skipping a step or mismanaging the order of operations can lead to rejection.

1. Investment Verification and Conformity

The process initiates with the execution of the chosen investment (e.g., property transfer or capital deposit). Once the transaction is finalized, the relevant authority (such as the Land Registry or BRSA) audits the investment and issues the "Certificate of Conformity." This document is the legal proof that the financial criteria have been met.

2. Specialized Investor Residence Permit

Before filing for naturalization, the applicant is required to obtain a specific short-term residence permit under Article 31/1-j of the Law on Foreigners. Often referred to colloquially as the investment visa Turkey, this permit is a mandatory prerequisite solely for the main applicant, distinguishing them from standard tourists or residents.

3. File Submission and Bureaucratic Review

The comprehensive application dossier is submitted to the Provincial Directorate of Census and Citizenship. For investors unavailable to visit in person, a Turkish citizenship by investment lawyer can manage the entire submission via a specialized power of attorney. In administrative hubs like Izmir, professional legal teams ensure the file is complete before it reaches the directorate, minimizing the risk of requests for additional documentation.

4. Security Clearance and Presidential Decision

Once accepted, the file undergoes an extensive security investigation by intelligence and police units. The final authority to grant Turkey investment citizenship rests with the Office of the President.

Timeline and Cost Structures

A strictly managed application typically concludes within 3 to 6 months, though this can vary based on bureaucratic volume. Investors frequently inquire about the total Turkish citizenship cost; beyond the core investment, one must budget for government processing fees, valuation reports, and translation taxes. However, when weighed against the strategic access provided, the effective Turkey passport price is often viewed as highly competitive compared to other global citizenship programs.

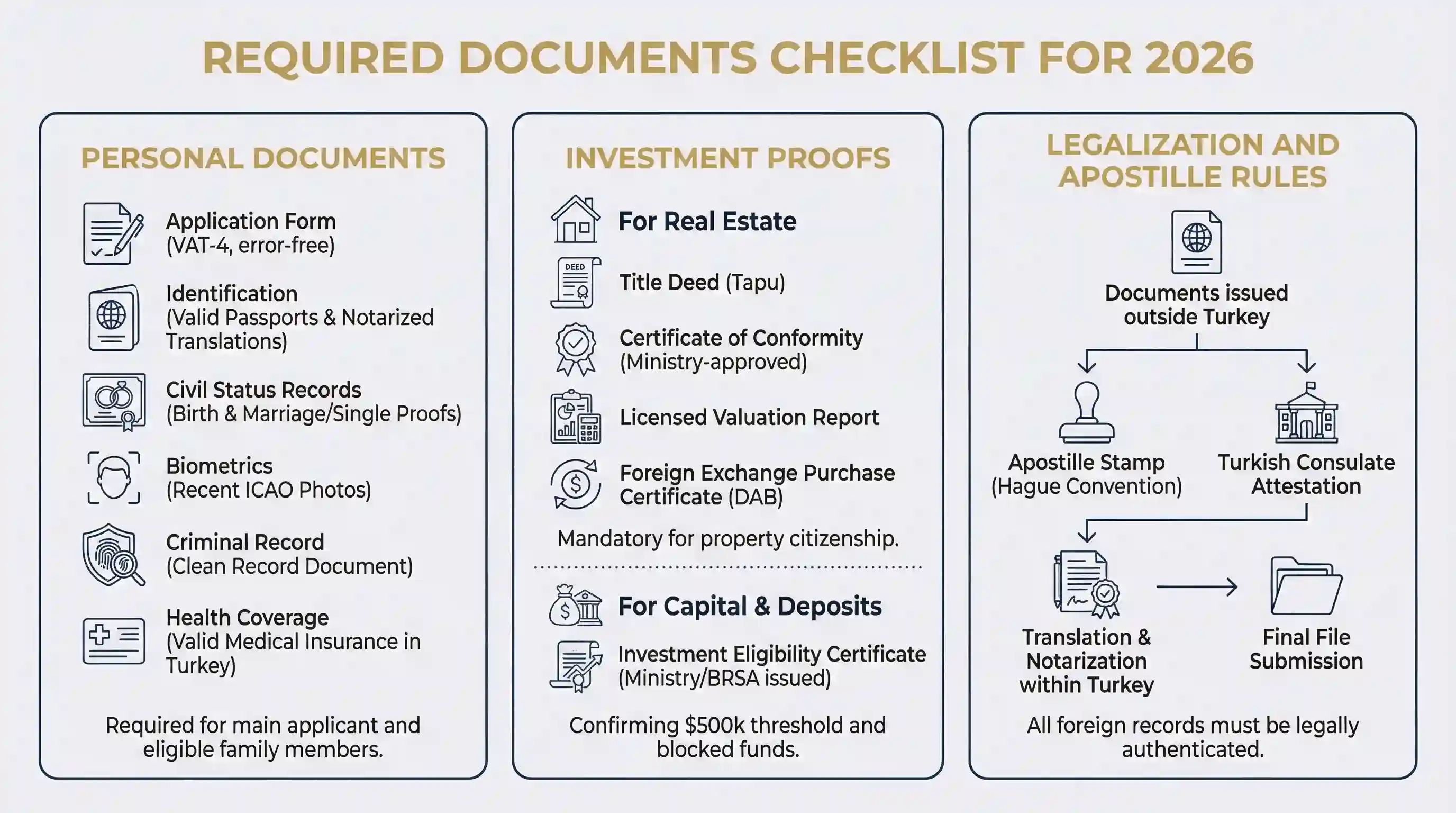

Required Documents Checklist for 2026

Compiling a legally compliant dossier is often the most operationally demanding phase of the naturalization journey. Under strict Turkish citizenship requirements, submitting a file that is incomplete, improperly translated, or lacks the necessary validation can lead to immediate administrative rejection.

Personal Documents

Regardless of the selected investment route, the following core documents must be presented for the main applicant and all eligible accompanying family members:

- Application Form: The standard VAT-4 naturalization form, completed without errors.

- Identification: Valid passports (originals) along with notarized Turkish translations.

- Civil Status Records: Birth certificates and marriage certificates (or proofs of single status) clearly demonstrating family ties.

- Biometrics: Recent biometric photographs adhering to ICAO standards.

- Criminal Record: A "clean record" document obtained from the applicant’s country of residence, proving good character and lack of criminal history.

- Health Coverage: Proof of valid medical insurance covering the applicant within Turkey.

Investment Proofs

Beyond personal identity, the file must legally verify the economic contribution with precise financial records:

- For Real Estate: The official Title Deed (Tapu), the Ministry-approved Certificate of Conformity, the Licensed Valuation Report, and the Foreign Exchange Purchase Certificate (DAB). This chain of evidence is mandatory when buying property in Turkey for citizenship.

- For Capital & Deposits: The Investment Eligibility Certificate issued by the relevant Ministry or BRSA, confirming that the Turkish citizenship investment 500k threshold has been met and the funds are legally blocked.

Legalization and Apostille Rules

A critical technicality often overlooked is the international authentication of documents. All official records issued outside of Turkey must legally bear an Apostille stamp (for Hague Convention countries) or be attested by the Turkish Consulate in the country of origin. Subsequently, these documents must be translated and notarized within Turkey. For investors coordinating this process from Izmir, working with a Turkey citizenship law firm is essential to ensure that every page meets these rigid bureaucratic standards before the file is submitted.

Why Choose KL Legal Consultancy in Izmir?

The journey to acquiring Turkish citizenship through investment is multifaceted, extending far beyond a simple financial transaction. Navigating the simultaneous coordination between banks, land registry offices, relevant ministries, and immigration authorities requires precise legal acumen. Without professional legal assistance for Turkish citizenship, investors risk facing significant administrative delays or even file rejection due to procedural errors or documentation gaps.

Benefits of Professional Legal Support

Experienced Turkish citizenship lawyers serve as strategic guardians throughout the naturalization process, providing critical oversight in three key areas:

- Risk Mitigation: Conducting deep due diligence to verify that a target property has no hidden legal encumbrances or debt liabilities.

- Regulatory Compliance: Ensuring all documents, from valuation reports to bank receipts, meet the strict standards required by the Directorate.

- Government Liaison: Managing direct communication with official bodies to track the file’s progress and resolve bureaucratic bottlenecks immediately.

Contact Our Izmir Citizenship Lawyers

Navigating this complex landscape requires a partner who understands both the local legal environment and the expectations of international investors. KL Legal Consultancy, based in Izmir, specializes in Foreigners Law and investment compliance. We handle the entire legal procedure—from initial investment due diligence to the final passport application—allowing you to focus on your business objectives while we secure your future status in Turkey.