Foreign Partnership Structures in Turkey

Why Invest in Turkey? Rights Under FDI Law

Turkey offers a dynamic environment for international business, where the Foreign Direct Investment Law guarantees the principle of equal treatment, granting international entrepreneurs the same rights as local investors. This legal ground facilitates company formation in Turkey, allowing for 100% foreign ownership in most sectors. However, while the statutory landscape appears welcoming, the practical application involves navigating complex administrative, financial, and regulatory layers.

Mere compliance with the law is often insufficient for a sustainable operation. Investors must carefully manage residency status, capital declarations, and public institution interactions to avoid bureaucratic bottlenecks. At KL Legal Consultancy, we observe that the initial structuring phase is decisive for the long-term success of any commercial entity. Whether you are planning a venture in the bustling trade hubs or seeking specific investment opportunities in Izmir, correct legal modeling prevents future liabilities regarding share transfers and banking protocols.

LLC vs. JSC: Choosing the Right Company Type

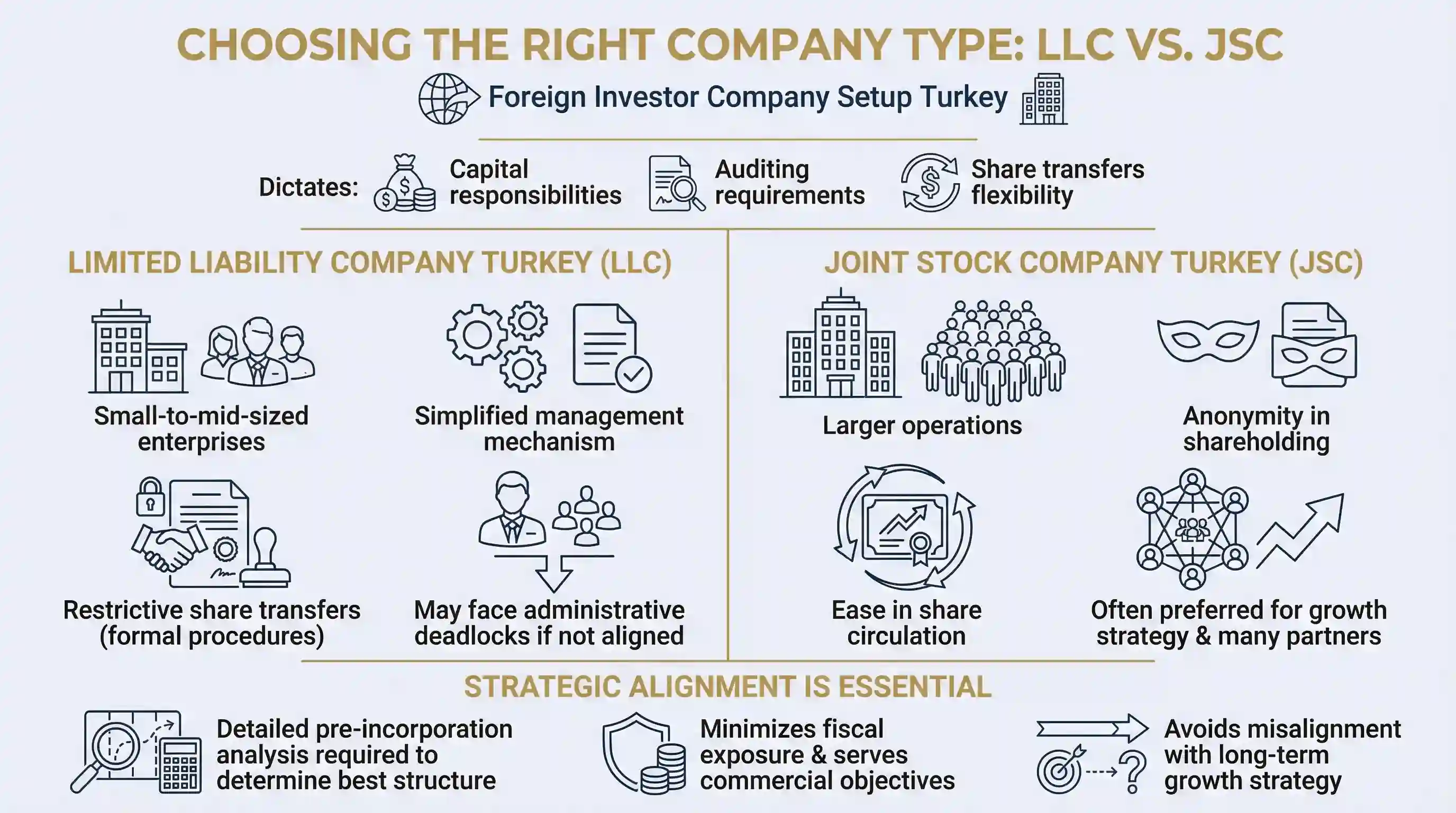

Foreign investors have access to the same corporate vehicles as Turkish nationals, yet the selection process demands a foresight that goes beyond simple registration costs. The decision between a Limited Liability Company Turkey (LLC) and a Joint Stock Company Turkey (JSC) fundamentally dictates the capital responsibilities, auditing requirements, and the flexibility of share transfers.

For many small-to-mid-sized enterprises, the LLC structure offers a more simplified management mechanism, though transferring shares requires formal procedures that can be restrictive. Conversely, a JSC is often preferred for larger operations or those seeking anonymity in shareholding and ease in share circulation. A foreign investor company setup Turkey often fails when the entity type does not align with the long-term growth strategy or the number of partners involved.

Our experience in the Izmir business community shows that choosing a structure merely for quick setup can lead to administrative deadlocks. A detailed pre-incorporation analysis is essential to determine whether the rigidity of an LLC or the complexity of a JSC best serves the commercial objectives and minimizes fiscal exposure.

How to Register a Company in Turkey (Step-by-Step)

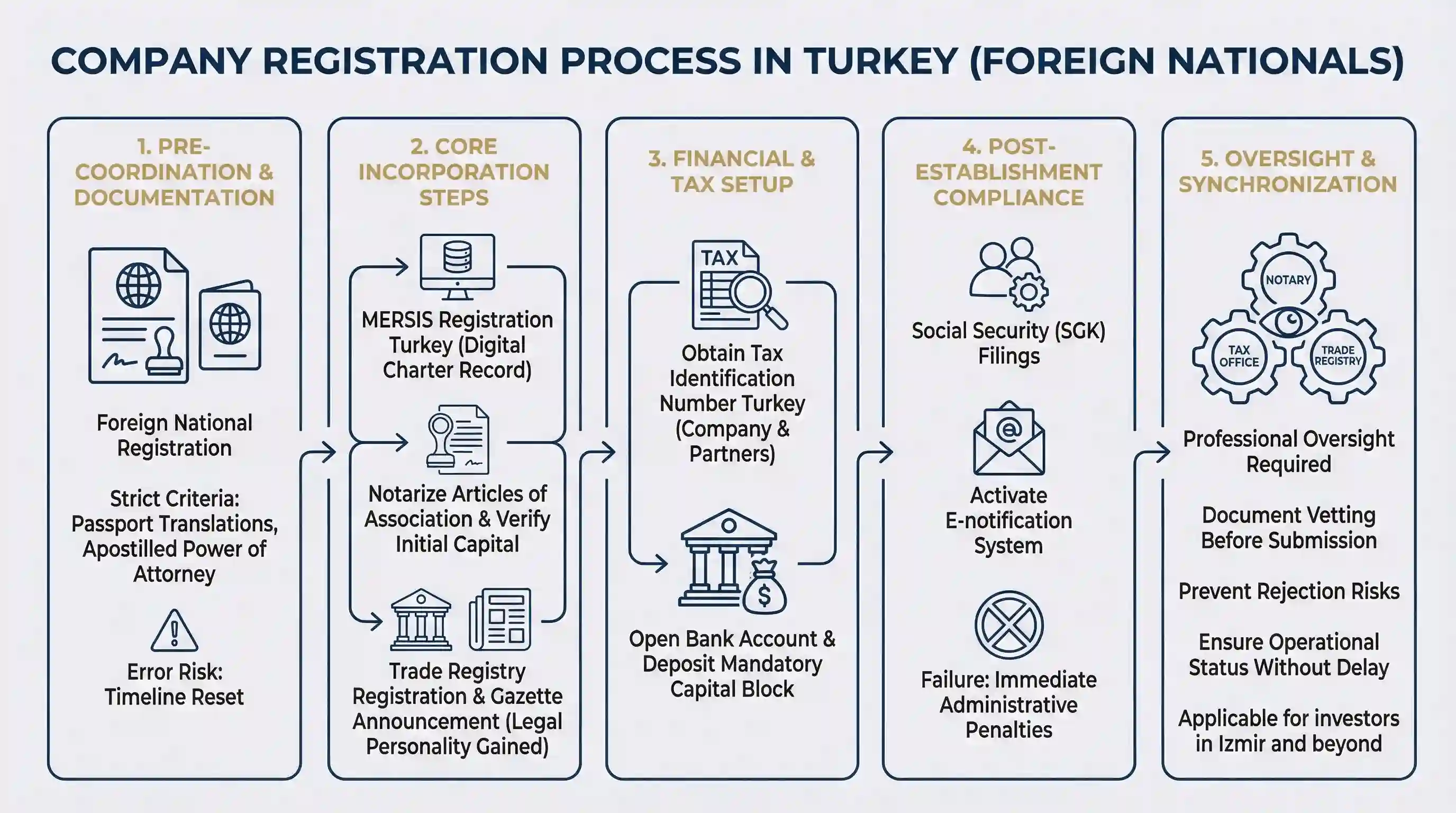

While technically similar to domestic formation, the workflow to register a company in Turkey for foreign nationals demands precise coordination. The bureaucracy involves a chain of approvals where a single documentation error can reset the timeline. The process is not merely about submitting forms but ensuring that international documents—such as passport translations and apostilled powers of attorney—meet the strict criteria of Turkish authorities.

The Turkey company incorporation steps generally begin with the MERSIS registration Turkey (Central Registry Record System), where the company's charter is digitally recorded. Following this, the articles of association must be notarized, and the initial capital competition verified. The official legal personality is gained only upon registration with the Trade Registry and subsequent announcement in the Turkish Trade Registry Gazette.

Simultaneously, the entity must obtain tax identification number Turkey for both the company and its non-resident partners. This is a prerequisite for opening bank accounts and depositing the mandatory capital block. Post-establishment compliance is equally critical; failure to immediately handle social security (SGK) filings or activate the e-notification system can trigger immediate administrative penalties.

For investors in Izmir and beyond, professional oversight is required to synchronize these interactions between notaries, tax offices, and trade registries. Our approach ensures that every document is vetted before submission, preventing rejection risks and ensuring the commercial entity is operational without delay.

100% Foreign Ownership & Sector Restrictions

The foundational principle of the Turkish commercial code allows international entrepreneurs to own 100% of a company's shares. In most industries, there is no ceiling on the ratio of foreign equity, meaning a foreign investor company setup Turkey can be executed without the need for a mandatory local partner. This freedom is a significant driver for direct investment, offering full operational control.

However, this liberty is not absolute. Specific legislation imposes strict caps on foreign shareholding in strategic sectors such as civil aviation, maritime, media and broadcasting, and private security. Additionally, acquiring land or establishing operations in military forbidden zones or security-sensitive areas often triggers special permission protocols or outright prohibitions. In these regulated industries, the minimum capital for company in Turkey and the permissible foreign equity ratio may differ significantly from standard commercial entities.

Operating under the assumption that "what is not forbidden is allowed" can be a fatal error in these sensitive areas. Regulatory bodies often require preliminary approvals before the trade registry process begins. Failure to secure these permits can lead to the revocation of licenses or the suspension of activities after significant capital has already been deployed.

For investments in industrial hubs or port cities like Izmir, where specific zones may have distinct regulatory overlays, a preliminary sector analysis is mandatory. This ensures that the shareholding structure is compliant with both national security laws and specific market regulations before the company is legally formed.

Management Rights & Board Control in Partnerships

Foreign shareholders possess the full legal capacity to participate in the management of their Turkish entities, whether as members of the Board of Directors in a Joint Stock Company or as Managers in a Limited Liability Company. This authority extends to representation, independent auditing, and operational decision-making. However, the extent of this control is strictly defined by the company's Articles of Association, a document that is often underestimated during the initial setup.

Relying on standard, template-based bylaws can be detrimental, especially in multi-partner structures. Without specific protective clauses—such as veto rights, privileged shares regarding board nominations, or specific quorum requirements—a foreign partner may find themselves marginalized in critical voting processes. It is essential to draft the Articles of Association to reflect the true balance of power, ensuring that minority shareholders retain influence over strategic decisions.

Furthermore, active participation in daily operations triggers additional compliance layers. While shareholding alone does not require residency, assuming an active executive role with signatory powers often necessitates obtaining a Work permit for company owners Turkey. Navigating the intersection of corporate law and immigration rules is crucial; otherwise, an appointed foreign manager may face legal barriers to exercising their duties physically within the country.

For businesses headquartered in Izmir or expanding across the region, defining these governance structures early prevents internal disputes. A well-constructed management framework ensures that the foreign investor is not merely a passive financier but holds legally secured executive power.

Taxation, Incentives & Avoiding Double Tax

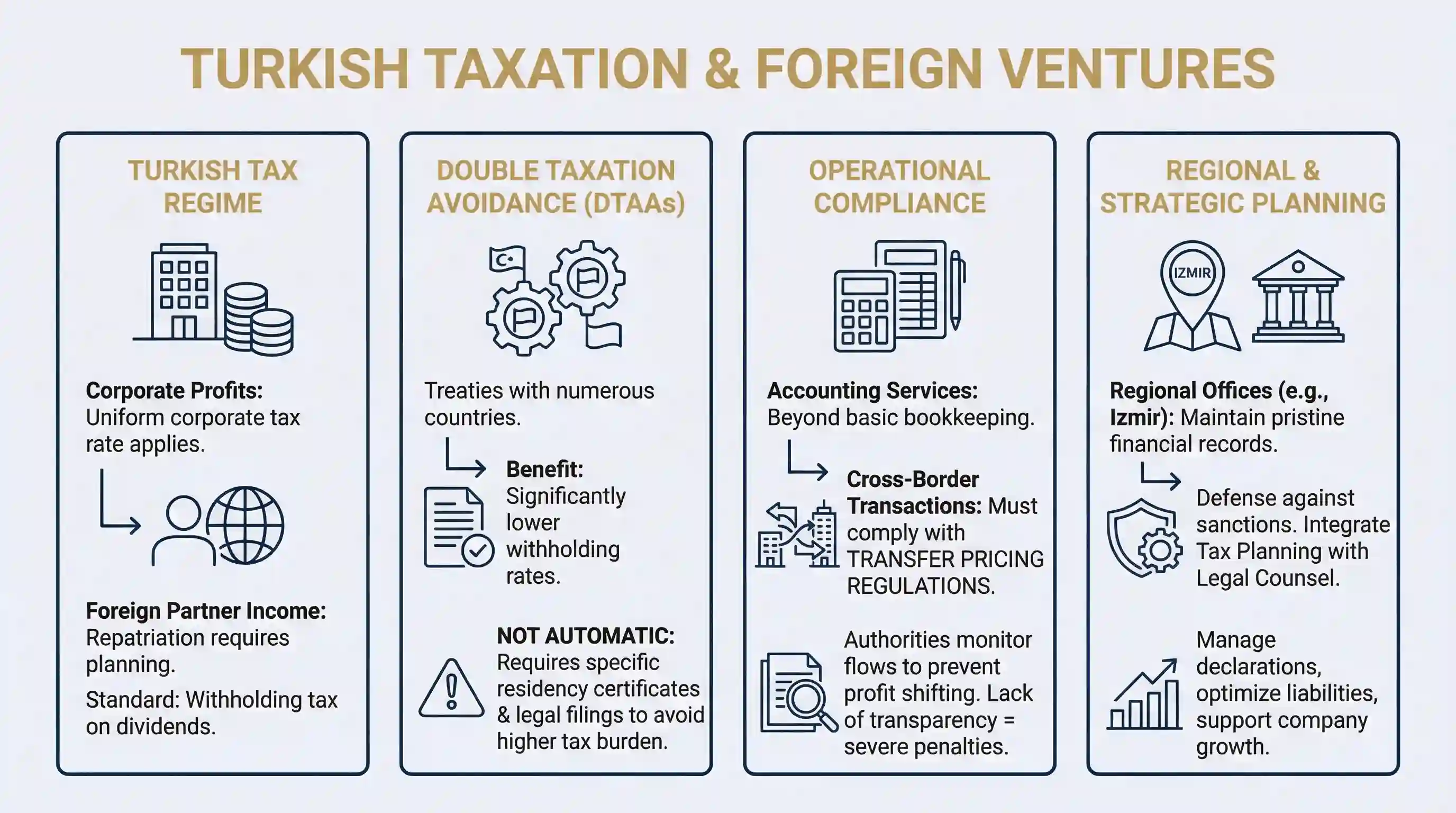

Navigating the Turkish tax regime is one of the most critical aspects of maintaining a profitable foreign venture. While the corporate tax rate applies uniformly to the entity's profits, the taxation of the foreign partner’s individual income—specifically regarding profit repatriation—requires sophisticated planning. The standard application involves withholding tax on dividends, but this is often optimized through international treaties.

Turkey has signed Double Taxation Avoidance Agreements with numerous countries, which can significantly lower the withholding rates on dividends for eligible foreign investors. However, these benefits are not automatic; they require specific residency certificates and legal filings. Without proper application of these treaties, investors often face a higher tax burden than necessary, paying taxes on the same income in both Turkey and their home jurisdiction.

Operational compliance is equally strict. Accounting services for foreign companies Turkey must go beyond basic bookkeeping; they must ensure that cross-border transactions, especially with parent companies or affiliates, comply with transfer pricing regulations. Turkish tax authorities closely monitor international money transfers and invoicing to prevent profit shifting. A lack of transparency or documentation in these financial flows can lead to severe penalties during audits.

For businesses based in Izmir or interacting with various regional tax offices, maintaining a pristine financial record is the first line of defense against administrative sanctions. From the moment the company is active, tax planning should be integrated with legal counsel to manage declarations, optimize fiscal liabilities, and ensure that the financial structure supports the company's growth rather than hindering it.

Opening a Corporate Bank Account & Capital Deposit

Establishing a commercial presence requires a functioning local bank account, a step that has become increasingly rigorous due to global compliance standards. While opening an account is technically a standard procedure, Turkish banks now enforce strict Know-Your-Customer (KYC) protocols for entities with foreign shareholding. This is not merely administrative; it involves a deep dive into the source of funds, the professional history of the partners, and the transparency of the business model.

The process typically begins with obtaining tax identification number Turkey for the foreign partners, which is a prerequisite for any banking interaction. Subsequently, a temporary account may be required to deposit the minimum capital for company in Turkey. For Joint Stock Companies, a specific portion of this capital must be blocked prior to registration. While Limited Liability Companies have more flexibility regarding the timing of the capital deposit, banks still require a fully compliant file—including the company charter and notarized identity documents—before authorizing any transaction.

A frequent bottleneck occurs when investors face enhanced due diligence checks, leading to unforeseen delays that can freeze the entire commercial launch. Compliance departments in major financial centers and cities like Izmir operate with strict internal guidelines; a rejection due to incomplete documentation or unclear business intent can complicate future applications across the banking sector.

To mitigate these risks, the financial presentation must be handled with the same precision as the legal incorporation. Presenting a clear business plan and a transparent ownership structure is essential to pass compliance filters. Strategic preparation ensures that the transition from a paper entity to a financially operational business occurs without being stalled by banking bureaucracy.

Annual Reporting & Ongoing Compliance Obligations

The responsibilities of a foreign entity do not end with the publication of its establishment in the gazette. While foreign-invested companies are subject to the same fiscal and labor audits as domestic firms—covering tax declarations, social security (SGK) filings, and occupational safety—they also face specific reporting obligations derived from their international capital structure.

A critical, often overlooked requirement is the mandatory reporting to the Ministry of Industry and Technology. Under the Foreign Direct Investment Law implementation regulations, companies must submit an annual "Activity Information Form for Foreign Direct Investments" by May of every year. Additionally, specific updates regarding capital increases or share transfers must be reported within one month of the transaction. Unlike standard domestic companies, foreign entities are monitored to track international capital flows and sector statistics.

Failure to maintain this transparency can result in administrative fines and may complicate future applications for work permits or capital increases. Regulatory bodies, including regional directorates in trade hubs like Izmir, effectively track these submissions electronically. Missing these deadlines alerts authorities to potential non-compliance, often triggering deeper audits into the company's financial records.

Maintaining a clean corporate standing requires an integrated approach where legal and financial advisors coordinate. Ensuring that both standard tax filings and specific foreign investment reports are submitted accurately and on time is the only way to shield the company from retrospective penalties and maintain a secure operational status.

Liquidation Process: How to Close a Company

Terminating a commercial presence is a juridical process often more rigorous than the initial company formation in Turkey. The decision to dissolve an entity is not merely an administrative halt; it triggers a specific legal status known as "Liquidation" (Tasfiye). During this phase, the company remains legally alive, but its capacity is restricted solely to winding up affairs—collecting receivables, paying debts, and converting assets to cash to satisfy creditors.

The procedure formally begins with a General Assembly resolution and the appointment of a Liquidator, whose authority must be registered and published in the Turkish Trade Registry Gazette. This publication initiates a mandatory waiting period, calling for creditors to present their claims. A common pitfall for investors is assuming that simply ceasing operations stops tax liabilities. In reality, until the legal personality is formally erased from the Trade Registry, corporate tax declarations and social security obligations continue to accrue, creating potential debt for the partners.

For foreign shareholders, the repatriation of the remaining capital is contingent upon obtaining "tax clearance certificates" from both the Tax Administration and the Social Security Institution. Any outstanding public debt blocks the final deregistration. In business hubs like Izmir, leaving a company "dormant" without formal closure often results in mounting electronic notification fines and tax penalties that can pursue the partners personally, even after they have left the country.

Properly managing this exit strategy is essential to ensure that the final liquidation balance sheet is approved and the remaining assets are lawfully distributed. Skipping these formal steps can lead to "ghost" liabilities that resurface years later, complicating the investor's future commercial activities or legal status in the jurisdiction.

Why Choose KL Legal Consultancy for Your Investment?

Entering the Turkish market is a decision that extends beyond commercial feasibility; it is a complex legal architecture project. From the initial Turkey company registration requirements to the final definitions of partnership rights, the quality of the legal groundwork determines the venture's resilience. The risks are not always visible at the start; a poorly drafted contract or an overlooked fiscal obligation often surfaces only when a dispute arises or an audit is triggered.

Operational security in Turkey requires more than just filling out forms; it demands a proactive legal partner who understands the intersection of commercial code, tax law, and international capital regulations. Whether securing a Turkey business visa for entrepreneurs or restructuring a multi-partner board, professional oversight ensures that your energy is spent on growth rather than navigating bureaucratic crises. For foreign investors, especially those coordinating activities from abroad or managing local operations in Izmir, working with a specialized legal team is the only way to guarantee that the corporate structure remains compliant, tax-efficient, and secure against future liabilities.